Small Contractors Expect the Unexpected with Peace of Mind Thanks to Their Utica First Artisan Contractor Policy

As summer heats up, so does the peak season for small contractor business owners. Whether seasoned contractors or new ventures, expecting the unexpected is a smart business move.

Small contractor business operations have many moving parts, and this particular line of business faces many hazards inherent to the trade. Utica First’s artisan contractor policies can mitigate some of these risks, such as personal injuries, equipment damage, or property damage, and provide small contractors with the peace of mind of knowing if something goes wrong, Utica First has them covered.

Types of Contractor Businesses We Write

We work with many types of contractors who specialize in residential work or serve as a sub-contractor:

Here are all the ways Utica First has small contractors covered:

- General Liability – protects a contracting business from loss of tools to property damage

- Commercial Property – protects the place where business is conducted and the things used to conduct business

- Business Income – covers the loss of income when the business cannot run because of a covered property loss

- Tools and Equipment – covers vital tools and equipment that are stolen or damaged

Tailored Coverage

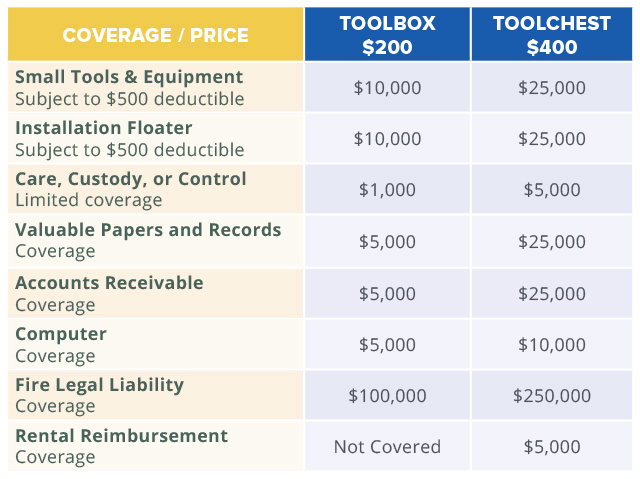

Small contractors can also enhance their coverage by tailoring their standard policy with one of these add-on Exclusive Tool Box or Tool Chest endorsements:

Utica First is known for its long-standing commitment to customer service excellence. We offer both credit card and eCheck payments, and we are always available to help you handle questions. If you have artisan contractor customers in the states of New York, New Jersey, Connecticut, Florida, Pennsylvania, Ohio, Maryland, Virginia, or Massachusetts, visit https://www.uticafirst.com/contractors/ to learn more about how to build the best artisan contractor coverage for your customers. #KeepingInsuranceSimple